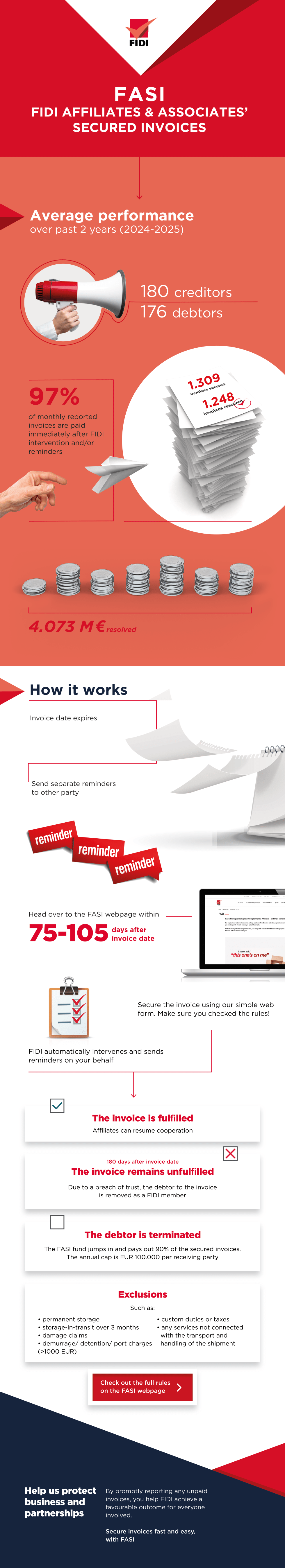

FASI

FASI: FIDI's payment protection plan

For any business to thrive it's essential to keep good cash flow. So when collecting payments becomes a concern, you need a plan in place to ensure you get paid promptly.

FIDI's financial protection programme, FASI, was designed to protect FIDI-FAIM and/or FIDI-DSP certified companies' working capital against the financial default of a FIDI colleague.

FASI - protecting your finances

The programme combines the FASI Scheme and the Payment Protection Plan.

- The FASI (FIDI Affiliates & Associates Secured Invoices) Scheme enables a FIDI member among others to report overdue invoices against other FIDI partners and to keep track of the litigation status of overdue invoices.

- The Payment Protection Plan comes into force should a FIDI partner go bankrupt or be terminated from FIDI. In this case, the payment protection plan helps the FASI creditor recover up to 90% of unpaid invoices.

If you would like to learn more about how FASI protects you as a FIDI partner, please contact fasi@fidi.org

FASI explained